Front Side

- Bank Name: Making it easier for merchants to recognize the Credit Card issuer at the time of transaction.

- Credit Card Type : Identifies the Credit Card program platform offered by the issuer.

- EMVV Chip: Europay, Mastercard, Visa global standard for chip-based credit transactions. Prevents counterfeiting of Credit Cards and facilitates maximizing security and global interoperability so that Credit Cards can continue to be accepted worldwide.

- Card Validity Period: Indicates the month and year of expiry of the Credit Card usage period.

- Cardholder Name : Only the name listed may use the Credit Card, in accordance with the identification at the time of applying for the Credit Card.

- Contactless Sign: A sign that the Credit Card can perform contactless transactions.

- Card Number: The 16 digit Credit Card number is unique to each Credit Card issuing bank.

- VISA Logo: Credit Cards can be used for transactions worldwide at merchants displaying the VISA logo.

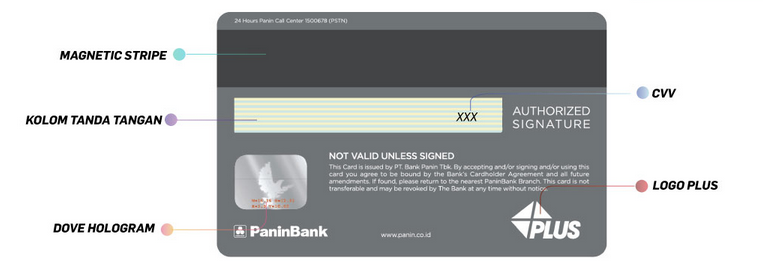

Back Side

- Magnetic Stripe: Magnetic stripe stores customer data for transaction authorization or cash withdrawal at ATM machines.

- Signature Column: Signature column as proof of Credit Card ownership.

- CVV: CVV is a 3-digit verification number printed on the back of the Credit Card for security purposes.

- Dove hologram: Dove hologram from the payment network serves as a security to avoid Credit Card counterfeiting.

- PLUS logo: The Credit Card can be used to withdraw cash at ATM machines with the PLUS don logo as well as VISA worldwide.

Please pay attention to the following points so that the Credit Card will not be able to be misused.

OTP

OTP (One Time Password) is a dynamic password sent by the bank or online marketplace sites via SMS/email, to request approval for transaction authorization. Do not tell your OTP that is sent to your cellphone number to any party, whether claiming to be PaninBank staff or others. PaninBank never asks for OTP for any reason. Immediately contact CallPanin if the transaction is not made by you as all losses arising from giving OTP to other parties will be the responsibility of the cardholder.

CVV

CVV (Card Verification Value) is the last 3 digits of the number found on the back of the credit card. Usually, this number can be found in the signature place on the back of the Credit Card. It is very important to always maintain the confidentiality of the CVV contained in your Credit Card. These three numbers will be needed when verifying various online transactions made with Credit Cards. Keep your CVV (3 digits on the back of your Credit Card) confidential, do not inform anyone including those who claim to be PaninBank officers.

PIN

Credit Card PIN (Personal Identification Number) is 6 numbers used for purchases at merchants and withdrawals at ATMs as a means of authorizing transactions both at home and abroad. The use of a PIN is more secure than a signature because a PIN consists of a series of numbers known only to the Credit Card owner. Because it is confidential, do not give the PIN to other parties, including PaninBank officers.

CREDIT CARD NUMBER

Avoid giving your Credit Card number to unauthorized parties. The number listed on the Credit Card contains various important information, including the identity of the credit card issuing company or institution itself. This is intended to facilitate identification and facilitate all financial transactions that will be carried out with the Credit Card.

DATA UPDATE

Panin Credit Card Holders are required to update their data by notifying PaninBank in writing/orally of any changes in address/phone number/mobile number for information purposes.

CHECKING PHONE NUMBER

If you get a phone call claiming to be from PaninBank to your cellphone, please check the phone number that appears on your cellphone number first. The CallPanin number 1500678 cannot make outgoing calls and is reserved only for incoming calls from customers.