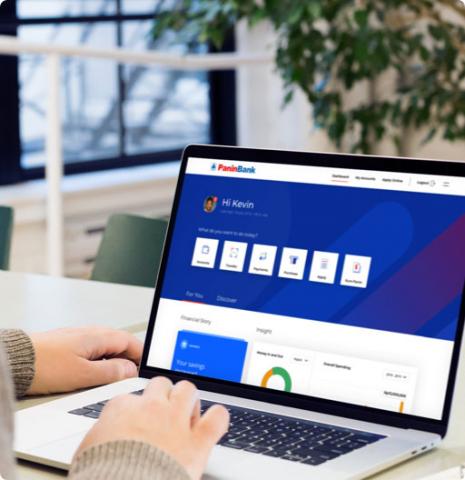

Trade issues goods from within the Indonesian customs territory in accordance with the applicable provisions. With this service the exporter (Beneficiary) is guaranteed payment as long as the exporter can submit documents or meet the conditions requested in L/C.

Benefit of Export

Pre Shipment Financing/ Pre-Export Financing

Pre Shipment Financing / Pre-Export Financing (Financing Before Shipping) Financing facilities for exporters to finance export preparations

Post Shipment /Post Export Financing

Post Shipment /Post Export Financing (Financing After Shipping) Financing facilities for exporters to help the exporter's cash flow:

Export Money Order Negotiations

Negotiation is an upfront payment to the Exporter through the takeover of export documents on the basis of L / C, thus the exporter does not need to wait for payment from the opening bank L / C. For you, the exporter customer of Bank Panin is ready to negotiate your export documents with reference to the applicable provisions.

Discountto Export Moneysel

Is an upfront payment to the exporter on the export futures L/C bill that has been received (accepted) by Bank Pembuka L / C. You may withdraw payment in advance by selling the bill to Bank Panin. Thus, your cashflow needs can be met immediately because you do not have to wait too long to get payment at maturity.

Letter of Credit Advising

L/C forwarding services from abroad to exporters

Outgoing Documentary Collection

Payment billing services to foreign parties based on required documents

- Have SIUP, TDP and NPWP

- Business license from technical departments / non-departmental government agencies

- For exports that are worth above Rp. 100 Million, exporters must also attach a Goods Export Notification (PEB) form